Investing lessons from corporate America’s $87 trillion carbon footprint

(Mark Hulbert, an author and longtime investment columnist, is the founder of the Hulbert Financial Digest; his Hulbert Ratings audits investment newsletter returns.)

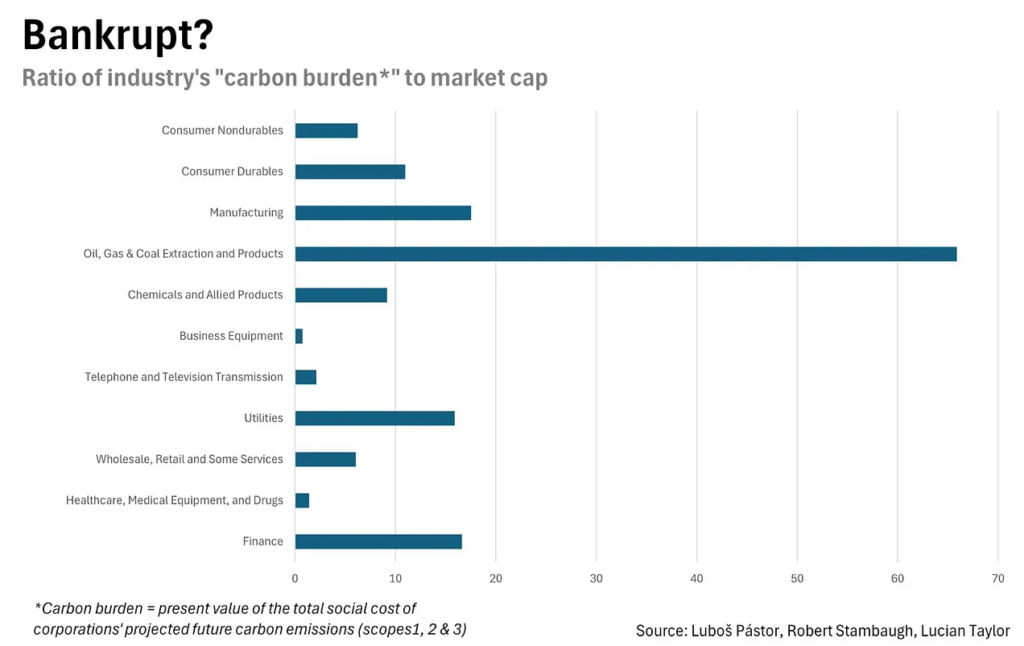

CHAPEL HILL, N.C. (Callaway Climate Insights) — Corporate America would be bankrupt if it had to pay for the damages caused by its greenhouse gas emissions.

READ MORE FROM MARK HULBERT

How to find a mutual fund that’s truly climate friendly

The huge differences in funds calling themselves ‘sustainable’

That’s the implication of just-completed research into the present value of the social cost of corporations’ future carbon emissions. Titled “Carbon Burden,” the study was conducted by Luboš Pástor of the University of Chicago’s Booth School of Business and Robert Stambaugh and Lucian Taylor of the Wharton School at the University of Pennsylvania. They estimated that corporate America’s total carbon burden is $87 trillion, which is 1.3 times its total market capitalization as of the end of 2023.

Calculating the present value of all future GHG emissions is a monumental undertaking, and necessarily comes with many qualifications. Though corporate America as a whole would be bankrupt if it incurred the total cost of its future greenhouse gas emissions, this isn’t true for all companies. Specifically, they found that 23% of corporations have carbon burdens that are less than their market caps — which means that 77% of firms have carbon burdens that exceed their market caps.

The chart above shows which industries would be most and least able to internalize the externalities of their GHG emissions. Not surprisingly, the oil, gas & coal industry is least able; the ratio of its carbon burden to market cap is 66 to 1. At the other end of the spectrum is the “Business Equipment” sector, for which the comparable ratio is 0.75 to 1 — meaning that the sector could bring its entire carbon burden onto its balance sheet and still have positive net worth.

Another important qualification is that it would be unfair to make corporations bear the full cost of their GHG emissions, both direct and indirect, since others in society bear some of the responsibility as well. But “quantifying the corporate externality [of GHG emissions] in a manner that accounts for responsibility seems infeasible,” the researchers write. This new study’s findings can be viewed as providing context for the total social cost of corporate GHG emissions.

How to calculate the carbon burden

Many additional qualifications to this new study’s conclusions trace to the assumptions they had to make in order to put a dollar figure on the social costs of future emissions. One big input into their calculations was the government’s estimate of the Social Cost of Carbon (SCC). The SCC represents the present value of the costs from emitting an additional ton of CO2 into the atmosphere, and the government’s estimates reflect an enormous amount of work of researchers in and out of government, including the National Academies of Science, Engineering, and Medicine. The EPA in 2024 raised the SCC to $190, up sharply from the $51 estimate used previously, and some believe the SCC should be even higher than $190. Needless to say, corporate America’s total carbon burden would be much larger than $87 trillion if a higher SCC estimate were used.

Another set of assumptions traces to estimates of corporations’ future GHG emissions. The authors of this new study relied on projections from the U.S. Energy Information Administration, the EPA, and MSCI, and took into account current government policy and corporate commitments for future GHG reductions. Needless to say, there is a lot of uncertainty in these estimates, and corporate America’s carbon burden could prove to be even larger than what the researchers estimate. We shouldn’t forget how artificial intelligence has led to a huge upsurge in projected energy usage that wasn’t even envisioned as recently as just a couple of years ago.

Investment implications

One of the most surprising conclusions of this new study emerged when estimating individual companies’ carbon burdens. They found that the companies with the biggest current carbon footprints—primarily in the energy and utility industries—are those that account for all of the projected decrease in U.S. carbon emissions between now and 2050. Climate-friendly investors should think twice before automatically shunning these companies in their portfolios.

According to the researchers, aggregate emissions from U.S. corporations are projected to drop from 2.0 billion metric tons to 1.5 tons by 2050, and over the same period the combined emissions of the 30 current largest emitters are projected to decline by 0.5 billion tons. That means that the aggregate emissions of all remaining corporations are not projected to change significantly over the next 25 years.

How can it be that these worst offenders will be the source of the greatest future progress? The authors of this new research refer to another study, entitled “The ESG – Innovation Disconnect: Evidence from Green Patenting,” this other study was conducted by Lauren Cohen, a professor at Harvard Business School; Umit Gurun, a professor at the University of Texas at Dallas; and Quoc Nguyen, a professor at DePaul University. That study found that many of the large energy companies that currently have large carbon footprints are at the cutting edge of climate change mitigation.

That earlier study evinced conflicting emotions among readers, some of whom insisted that these large current emitters don’t deserve any accolades for focusing on offsetting a portion of the enormous damage they have inflicted on the climate. That may be. But for those with a single-minded focus on reducing GHG emissions, assigning credit or blame is of secondary importance to what actually helps to get the job done.

Sponsor

Find a Vetted Financial Advisor

- Finding a fiduciary financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 financial advisors that serve your area in 5 minutes.

- Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. Get on the path toward achieving your financial goals!