GM’s Shattered EV Dreams

GM announced earnings. They were better than expected. It pulled full-year guidance because of the UAW strike. The most important thing America’s largest car company said was about neither. Importantly, management commented that EV demand was weak and that it would dial back production. GM did so during what is supposed to be the dawn of EVs in America.

GM’s third-quarter revenue was $44.3 billion. That was up 5% from the previous year. Net income dropped 7% to $3.1 billion. The figures show how tight net income margins are and the damage the UAW could do if a strike is prolonged and GM’s production drops by hundreds of thousands of vehicles.

According to CNBC, CFO Paul Jacobson said, “GM also is pulling near-term targets for its electric vehicles amid slower-than-expected demand.” Ford indicated similar EV headwinds just weeks ago.

EV manufacturers have started to cut prices. This includes market leader Tesla. This factor hurt its earnings in the most recently reported quarter. However, Tesla said its cost of goods sold will be lower in the future, a hint at improved margins.

The results across GM, Ford, and Tesla beg the question of why EV sales are not exploding as expected. Every major car company globally has set a goal of at least half of its 2030 production as EVs. Gas-powered cars should have begun a rapid sunset by that time.

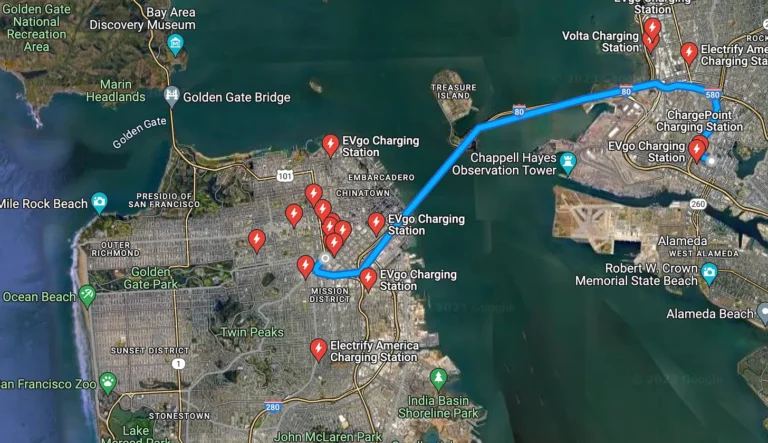

The problem with EV sales in the US and GM’s problem probably boils down to a broad rejection of these vehicles by the US public. Several surveys show many Americans want to stay with gas-powered cars, albeit with smaller engines. Why? These surveys of potential buyers report that EVs take much longer to “fuel” than gas-powered ones. They also believe it is hard to find EV charging stations. There are 125,000 gas stations in the US. And people are worried about the range of EVs. Trips of over 300 miles mean at least one stop, and often at an inconvenient charging station.

Tesla made its decision about EVs when it was founded. Its risk of disappointing Wall Street is modest and is based on whether its profits are more or less each quarter compared to the same quarter the year before. For Ford and GM, this is an existential moment. These two century-old companies could fall apart in less than a decade if their EV sales do not increase.

More from ClimateCrisis 247

- BYD To Pass Tesla Global EV Sales

- Warren Buffett Dumps Shares Of China EV Company BYD

- Porsche’s Electric Car Problem

- Cheap EVs May Save The Industry