Three surprises investors should watch for at COP28 next week

This commentary was first published in Callaway Climate Insights, a partner of ClimateCrisis247. To read everything on CCI, subscribe now for full access.

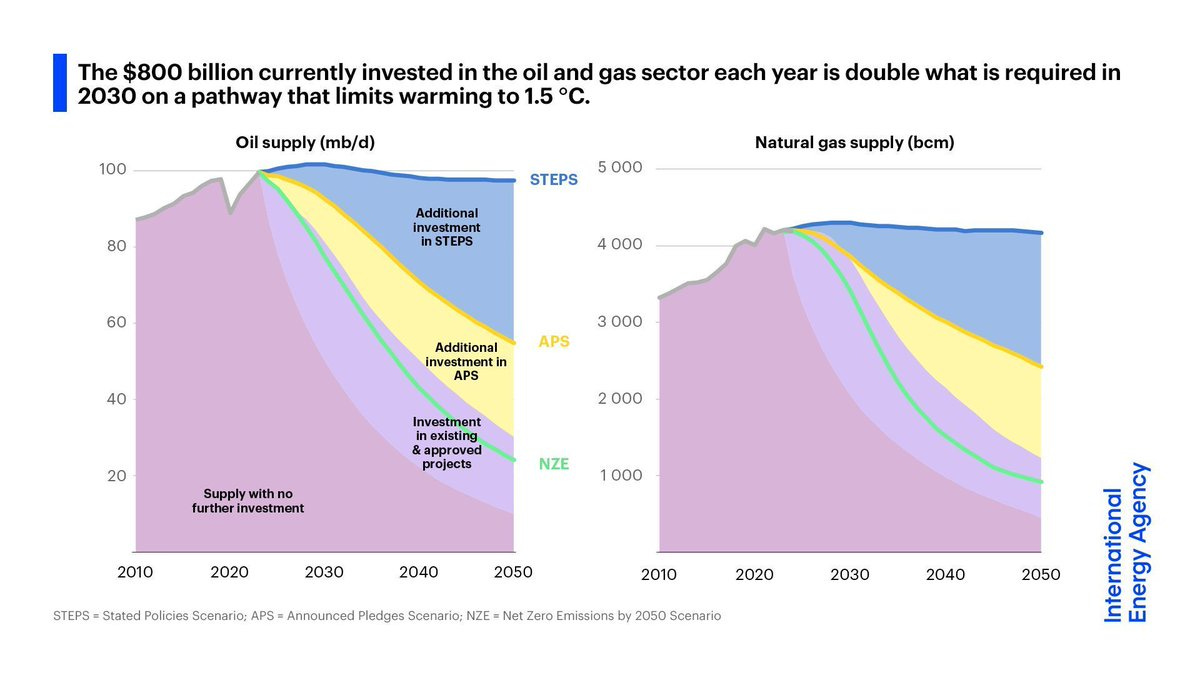

More than we need: While oil & gas production is far lower in net zero transitions, some investment in supply is still needed, says the IEA. The $800 billion currently invested in the sector each year is double what’s required in 2030 to limit global warming to 1.5°C.

With more than 70,000 people attending the COP28 climate summit in Dubai over the next two weeks, we can expect a lot of noise. Controversy, protests, perhaps even the occasional broad agreement on something like limiting methane leaks. But with much of the action on the sidelines of the official summit, investors will need to work hard to cut through the noise for ideas.

Day one started with an agreement to adopt a fund inside the World Bank to help poor nations handle climate disasters, and almost $280 million pledged immediately from the U.S., UK, EU, and Japan. Though billed as a quick win for UAE hosts, this was actually a managed victory. The fund had been agreed on weeks ago after arduous negotiations on where to house it. It was formally signed today.

Here are three real potential surprises we’ll be looking for in the coming days.

- More exotic financing ideas for handling “loss and damages” for poor countries. BlackRock BLK -0.03%↓ kicked this off a few days ago with a report that recommends turning funding from large multinational institutions such as the World Bank into backstops for private investor money, limiting risks on emerging market debt bets. Incentivizing private money to come into this traditionally risky arena is the only way to achieve the scale governments need to make a difference.

While progress has been made in setting up a loss and damages fund inside the World Bank, without private money there just won’t be enough to cover the $1 trillion estimated to be needed, more than ten times the current fund size. Look for the World Bank’s Ajay Banga to make news on this next week after the global leaders depart this weekend. - A coordinated carbon capture and storage strategy among oil states and the largest companies. With all the pressure on COP28 President Sultan Al-Jabar about turning the summit into an oil fest, the head of the UAE’s national oil company must complete a grand deal among Big Oil to succeed. Carbon capture and storage (CCS), one of the hottest subjects among investors but one that scientists say is still not scalable enough to reduce the emissions we need, is almost certain to be the centerpiece of such a deal.

We expect several major CCS “breakthrough” announcements in the next few weeks. Only a coordinated deal that includes an specific emissions reduction goal that all can follow will be considered a win. This area, however, is the best shot investors might have in identifying a technology, and company, to bet on in the next several months. One clue to a possible deal is that Exxon CEO Darren Woods is rumored to be coming next week, the first time for a Big Oil CEO at a COP event. - A nuclear energy breakthrough, perhaps in fusion technology. This is known as the head fake strategy. As Al-Jabar seeks to deflect criticism from the oil jamboree he will oversee, making a big deal about advancements in nuclear energy seems a given. The idea of mobile or small nuclear generators suffered this year after a high-profile project between the U.S. Energy Department and NuScale, an Oregon company considered the leader in the technology, collapsed.

Any news of a revival of the deal or new deals would re-energize, so to speak, interest in the area championed by Bill Gates, among others. But why stop there? What would really turn investor heads would be any news of substantial progress in creating renewable energy through nuclear fusion (as opposed to the traditional fission), which is still largely untested.

There will be many, many other announcements and as usual the final deal between governments on loss and damage and whether to “phase out” or “phase down” oil will drag past the end of the summit and imperil everyone’s holiday plans. But for investors looking for ways to speculate on this year’s climate summit, these three areas seem to us to have the most potential.

More from ClimateCrisis 247

- Global Deal On Plastic Pollution Falls Apart

- Lies About Climate Disaster Could Be Blocked By AI

- Only One Nation In The World Can Feed Itself

- Melting Glaciers Could Drive Volcanos