Turning Climate Change Risks into Economic Opportunities

In a recent study on combating climate issues, the business sector is called to the forefront of the battle against climate change. The report “From Risk to Reward: The Business Imperative to Finance Climate Adaptation and Resilience” shifts the narrative from viewing climate change solely as a threat to recognizing it as a catalyst for economic opportunity and innovation. As the world grapples with the escalating impacts of climate change, including extreme weather events and natural disasters, the urgency for adaptation and resilience has never been more apparent. The report underscores the stark reality facing businesses and economies, particularly in emerging markets and developing economies, which are disproportionately affected by climate risks. Without immediate and proactive investment in climate adaptation, the global economy stands to suffer immense losses.

DISCOVER: No, Climate Change Is Not The Sun’s Fault

READ MORE: Study Shows Most Americans Aren’t Scared Of Climate Change

A Strategic Framework for Business Engagement

The report, by Boston Consulting Group (BCG), in collaboration with the Global Resilience Partnership and the US Agency for International Development, introduces a strategic framework centered around three critical opportunities for the private sector: Protect, Grow, and Participate. This framework guides businesses in mitigating climate risks and highlights the economic benefits of investing in climate adaptation and resilience.

Protect: The first pillar emphasizes safeguarding assets, supply chains, and operations. Companies are encouraged to finance measures that protect against future climate-related losses, such as improving infrastructure resilience and implementing advanced climate analytics. The report showcases examples where businesses have successfully mitigated risks through proactive adaptation measures, demonstrating that the cost of inaction far outweighs the investment in protection.

Grow: This opportunity focuses on the burgeoning market for adaptation and resilience solutions. Businesses can tap into a rapidly growing market by financing early-stage and growth-stage companies developing innovative solutions and investing in new product lines within mature companies. The report highlights the diverse investment opportunities across sectors such as agriculture, water management, and energy efficiency. It presents a compelling case for the economic potential of these investments, with some adaptation and resilience solutions providers earning valuation multiples as high as 77x revenue.

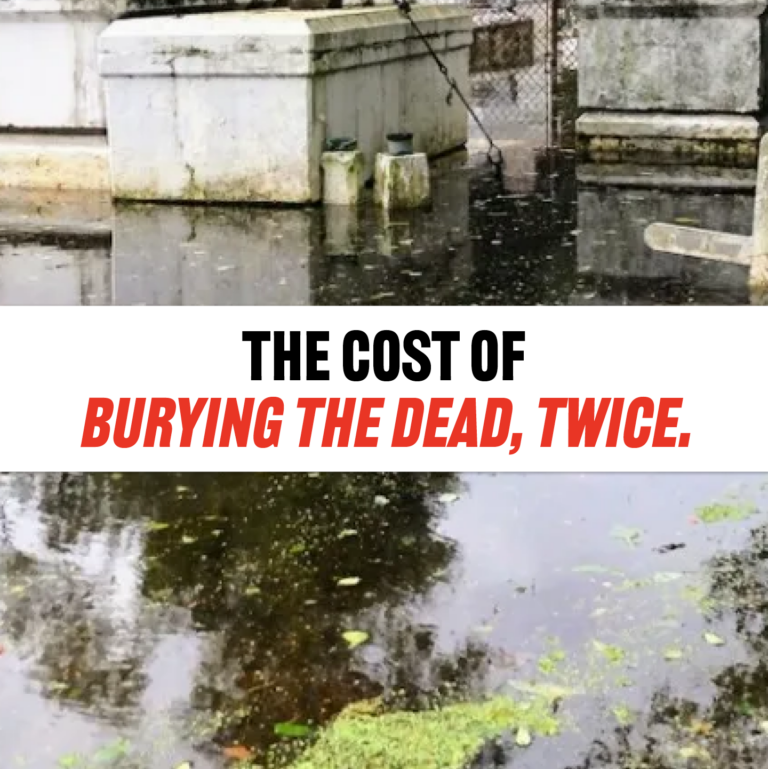

Participate: The final pillar calls for private sector collaboration with the public sector in implementing large-scale adaptation and resilience projects. Through public-private partnerships, businesses can contribute to critical infrastructure projects that enhance societal resilience and offer stable returns on investment. The report cites successful partnerships in water management and stormwater infrastructure as models for how private capital can be effectively mobilized for the public good.

Mobilizing Capital for Climate Action

A key message of the report is the critical need for increased private sector financing in climate adaptation initiatives. While public and philanthropic funding remains essential, the scale of investment required to address climate risks effectively necessitates a significant contribution from private financiers. The report advocates for innovative financing models, such as blended finance, that leverage the strengths of both the public and private sectors to maximize impact. The information calls businesses, investors, and policymakers to recognize the urgency of climate adaptation and seize the economic opportunities it presents. By reorienting investment strategies towards resilience and innovation, the private sector can play a pivotal role in mitigating the impacts of climate change while driving economic growth. The report’s findings and recommendations offer a comprehensive roadmap for harnessing the transformative power of finance in building a sustainable and resilient future. As businesses and investors respond to this call to action, they safeguard their interests and contribute to the global effort to combat climate change.

In conclusion, the report marks a significant step forward in climate adaptation and resilience discourse. It challenges the business community to view climate change not just as a risk to be managed but as an opportunity for innovation, growth, and leadership in the transition to a resilient global economy. The path to a climate-ready world is fraught with challenges. Still, with strategic investment and collaboration, the private sector has the potential to lead the way in creating a more sustainable and resilient future for all.

Climate Crisis 24/7 used generative AI technology to help produce this article, which a human editor at Climate Crisis 24/7 edited. Climate Crisis 24/7 is dedicated to accuracy and transparency; any article that uses AI will be noted.

This report, “From Risk to Reward: The Business Imperative to Finance Climate Adaptation and Resilience,” was done by the Boston Consulting Group (BCG), in collaboration with Global Resilience Partnership and the US Agency for International Development.