Buying EVs Just Got Much More Expensive

Customers who bought EVs in the US until the first of this year could often get a government tax credit of as much as $7,500, depending on the model. According to Reuters, the number of models that qualify for the credit collapsed from 43 to 19 yesterday. As an example, a Tesla Model 3 RWD, with a $7,500 rebate, will cost $33,130 in 2023. Without the credit, the price rises to $40,630, a 23% increase. The math is similar for many other EVs that no longer qualify.

More on EVs: America’s only 500-mile range EV is made by a troubled company.

Help for cars: America’s gas prices may lower inflation.

Every major car company with EV models faces the same problem: GM lost credits on its Lyriq and Blazer EV, Chevrolet Equinox EV, Chevrolet Silverado EV, GMC Sierra EV, and Cadillac OPTIQ. Other EVs that lost the government credit include the Volkswagen ID.4, BMW X5 xDrive50e, Audi Q5 PHEV 55, and Ford E-Transit. Some car companies hope to return to the government credit list by slightly changing where their EV models are assembled.

The credit system is complex. Created to entice buyers to move from gas-powered cars to EVs, it has become a subtle way to get people in the US to “buy American.” EVs primarily assembled in North America usually qualify. The Treasury Department began using the credit to influence the purchase decisions of buyers who might purchase cars that used Chinese components. “The Treasury issued guidelines in December detailing new battery sourcing requirements aimed at weaning the U.S. electric vehicle supply chain away from China,” the NADA reported

The credit system was always complicated and aimed mainly at middle-class Americans based on income. The $7,500 credit is actually—two $3,750 credits. One is based on where raw materials inside batteries are sourced. This includes lithium, graphite, and cobalt. The second is based on where batteries are manufactured. In each case, the required location for assembly to get the credit is within North America. The MSRP of the qualified vehicles was capped at $55,000 for cars and $80,000 for trucks and SUVs. Households with couples filing jointly with incomes over $300,000 do not qualify for the credits. Neither do heads of households who make over $225,000.

The federal government’s decision to cut credits may have made the industry’s path to sharply increased sales in 2024 more difficult. The declining success of the market leader is a sign of the industry’s challenge. The increase in Tesla sales has begun to slow. Its vehicle deliveries last year were 1.81 million, up 35%. While the growth rate seems extraordinary, it is not the pace Tesla has posted in previous years.

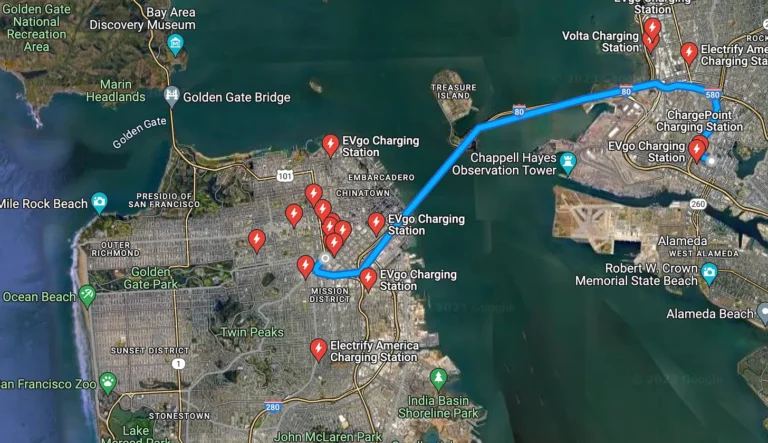

As their customer base has moved beyond early adopters, EV manufacturers have encountered other problems. Among these problems is that it can take several hours to fully charge a car battery. It takes about 10 minutes to fill a car or truck’s gas tank. EVs have a range of slightly more than 300 miles, less by a wide margin than many gas-powered cars. Charging stations are available in large cities, and many people charge their cars at home. However, outside population centers, charging stations are scarce and not always in convenient locations.

More from ClimateCrisis 247

- BYD To Pass Tesla Global EV Sales

- Warren Buffett Dumps Shares Of China EV Company BYD

- Porsche’s Electric Car Problem

- Cheap EVs May Save The Industry