Tesla Is Worth 16 Times More Than Ford

Ford’s revenue in 2023 is likely to be as high as $175 billion, and should have a net income of over $9 billion. Ford will sell over 2 million vehicles worldwide. Tesla’s auto revenue for the year should be $100 billion, on which it should make $10 billion. Tesla delivered 1.81 million cars in 2023. So, why is Tesla’s market cap 16 times greater than Ford’s?

EV trouble: America’s only 500-range EV is built by a troubled company.

Help for the car industry: Lower gas prices help soft landing.

Tesla continues to be the EV market leader. Investors need to believe EVs are the car industry’s future to keep Tesla’s share price at levels many investors who work with fundamentals do not believe can be justified. The financial benefits to investors of the Tesla gamble are not a sure thing. EV sales growth rates, particularly outside China, have begun to slow..

Ford’s EV business is a disaster. It has no realistic claim that it will become successful based on what investors, climate scientists, and government officials believe is the critical role EVs will play in transportation. This will be especially true toward the end of the decade. Every major car company worldwide is investing billions of dollars in EV design, production, and distribution. This is not due to a decision by car executives to change the direction of the global warming future. The motive is profit. The White House has set a goal that 50% of cars sold in the US in 2030 will have electric engines. European political leaders have set similar goals. China’s rotation from gas to electric cars is at a pace faster than either of these.

Ford has not been able to demonstrate that it will have a significant market share in the EV industry. It recently delayed a $12 billion investment in its EV operations. Its EV sales are only in the thousands each month. Ford sold 1,803,569 vehicles in the US through last November and 6790,048 of its flagship F-series trucks. The F-150 has been the best-selling vehicle in the US for over four decades. Over the same period, Ford sold only 20,365 F-150 Lightning EV versions.

There is another reason investors have lost interest in Ford. Ford has to work with the UAW. Tesla does not. The recent UAW strike added $1.7 billion to Ford’s costs last year, and the costs over the next four years will be over $8 billion, according to Ford management. This creates a really significant labor cost advantage for Tesla.

Ford has discovered that EV sales in general are slower than the industry expected.

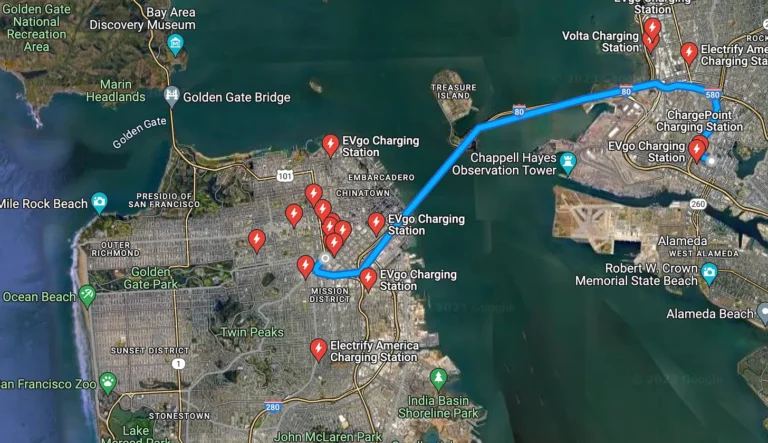

EV sales rates have declined in the US. Potential customers are concerned about owning cars with a range of only 300 miles. They are anxious about the limited number of charging stations. They are apprehensive about how long it takes to charge an EV battery. Since demand has slowed, and Tesla has over 50% of the market, Ford has to split the balance with a dozen or more global manufacturers who want to be the US EV leaders.

Market capitalization is not the only proof of the difference in investor sentiment between Ford and Tesla. Tesla’s stock is up 102% over the last year, while Ford’s is up 5%. Whether EV sales in the US will ever overtake gas engine vehicle sales is open to debate. Ford’s chances of having a meaningful part of whatever success the EV industry has are small.

More from ClimateCrisis 247

- BYD To Pass Tesla Global EV Sales

- Warren Buffett Dumps Shares Of China EV Company BYD

- Porsche’s Electric Car Problem

- Cheap EVs May Save The Industry