Fossil Fuel Polluter Giant Created By M&A

Diamondback Energy and Endeavor Energy Resources are merging to create an oil-and-gas behemoth worth over $50 billion. It creates a formable new company to operate in the Permian Basin, the massive oil reserves in West Texas and New Mexico.

Why do oil mergers work? Americans love gas guzzlers.

Late last year, Bloomberg reported:” But after years of declines, flaring is on the rise again in the biggest US oilfield. Altogether, producers in the Permian Basin in Texas and New Mexico flared about 97 billion cubic feet of the fuel in the year ended June 30, a Bloomberg News analysis shows.” Diamondback Energy Inc. and Permian Resources Corp were listed as two of the companies.

The deal should create a level of anxiety. Consolidation makes exploration and production more efficient. According to The Guardian, “Companies are rushing to use their huge profits to increase output, despite analysis by the International Energy Agency (IEA) that said new fossil fuel developments would push the world beyond the safe limits of global heating.”

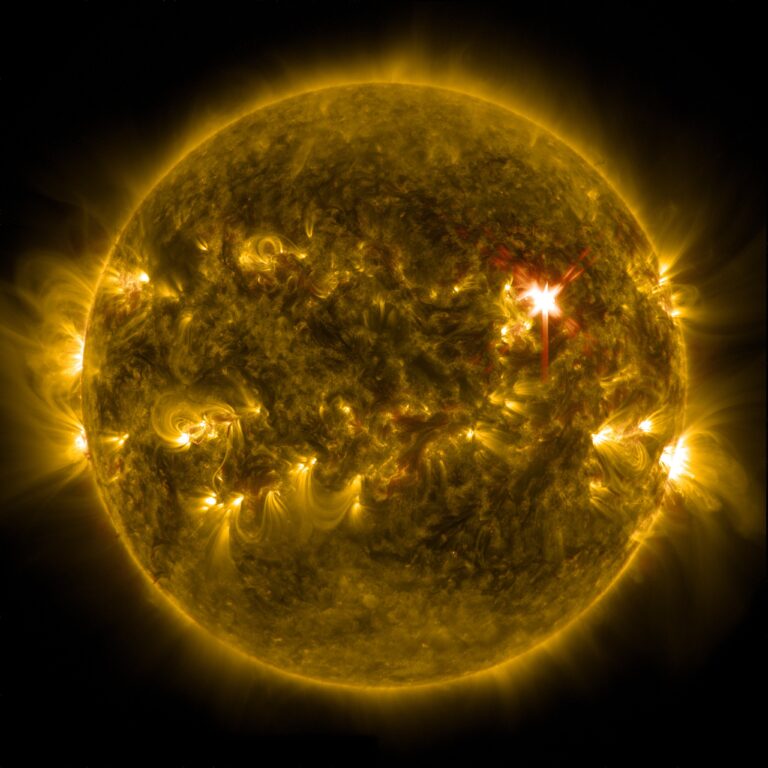

Permian Basin

The Permian Basin covers more than 86,000 square miles. It is the largest producing oil field in the US. According to Scientific American, “A recent study by the Environmental Defense Fund found that 3.7% of natural gas produced in the Permian Basin leaked into the atmosphere. That’s enough to erase the greenhouse gas benefits of quitting coal for gas in the near term.”

Despite an attempt to throttle greenhouse gas emissions, oil giants are growing larger, mainly because of M&A activity. The transactions are also a clear signal that aggressive oil and gas products will continue…otherwise, why merge? M&A is done for profits.

More from ClimateCrisis 247

- Oil Become Energy King Again

- It’s fracking marvelous: Geothermal set to Become Miracle new Energy Source

- Drill, Exxon, drill: Largest U.S. Oil company announces Aggressive production Plan

- Opinion: COP29 Has Become A sad, Sad Circus Where Big Oil is the Boss