Americans Love These Cars, But Manufacturer Falls Apart

A new study from Consumer Reports titled “The Cars People Love Most.” was released this month. Among the people surveyed, the 10 “most satisfying” included two vehicles from Rivian, the deeply troubled EV SUV and pickup company. On a scale of one through 100, the Rivian R1T finished second with a score of 88, just behind the Chevy Corvette, which scored 93. The Rivian R1S finished sixth with a score of 84. Based on RIvian’s stock price and financials, it may not be around for long, at least as an independent company.

Ford’s Future—A Major EV Failure

Tesla Killer? Could Be

Rivian makes very expensive EVs. The R1T pickup has an average price of over $75,000. The R1S, an SUV, is priced about the same. According to Automotive News, Rivian recently dropped prices on some of its models. One hurdle the EV industry has faced is the high price of its vehicles.

Rivian went public in 2021 with a market cap of $100 billion. The price per share has dropped 77% in the last two years. Rivian’s market cap is currently $15 billion, which is probably too high based on its financial position. Barclays analyst Dan Levy recently downgraded Rivian’s shares. In his note on the decision, he said that Rivian was poorly positioned for the recent drop in demand across the EV industry. Recently, Ford, which makes its own EV pick-up–the F-150 Lightning–delayed a multibillion plan to increase EV protection. Tesla, the market leader and maker of the EV pickup Cybertruck, also expects 2024 sales to be challenging.

Rivian’s Weak Sales

Rivian’s recent figures were weak. It produced 17,541 vehicles and delivered 13,972 cars in the quarter that ended December 31. For the full year, it produced 57,232 vehicles and delivered 50,122.

In the third quarter of 2023, the most recently reported, revenue was $1.33 billion, up from $536 million in the same quarter the year before. It lost $1.4 billion, down from $1.8 billion in the same quarter a year ago. Over the five quarters that began with the third quarter of 2022, Rivian has posted a net loss of $7.4 billion.

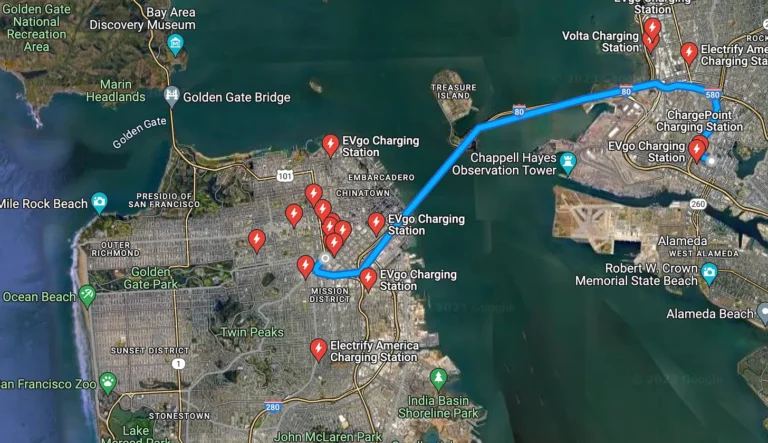

EV sales are in trouble, both in the US and Europe. Many consumers do not want vehicles with few charging stations, long charging times, and limited ranges, especially in cold weather. RIvian is too tiny and has a weak balance sheet to survive until these trends reverse. The fear that an EV manufacturer will fail is another reason some people won’t buy an electric car, even if they like it.