Ford’s Newest Tesla Killer

After posting abysmal EV sales in January, Ford has prepared itself for another run at Tesla. Ford’s major attempts, the F-150 Lightning and Mustang Mach-E, have posted poor unit sales. At the same time, Tesla has 50% of the US EV market.

A primary theory about why EV adoption in the US has been low is relatively high prices. Even the entry-level Tesla Model 3 is considered high prices in a market in which most Americans continue to buy gas-powered cars and hybrids. Tesla understands the need for lower-priced models better than US companies. Its success in China has pitted it against local BYD. BYD has perfected mass-market EV development that brings down prices to $10,000.

Tesla is expected to make a car priced under $30,000 in the US. The Model 2 will likely be a hatchback made in Tesla’s Mexico facilities. A new price model could help Tesla keep its 50% market share despite growing competition in the US from virtually every large manufacturer from Europe, Japan, and South Korea, along with GM and Ford.

Green Gets Cheap

After Ford announced what turned out to be good earnings, management told investors that it expected to launch lowered-priced EVs. Green Car Reports commented, “Ford may have shifted to be even more focused on affordability since 2022, when EVs were in short supply and sold with dealership-imposed premiums, well before a $25,000 Tesla was pegged for Texas production, potentially next year. “

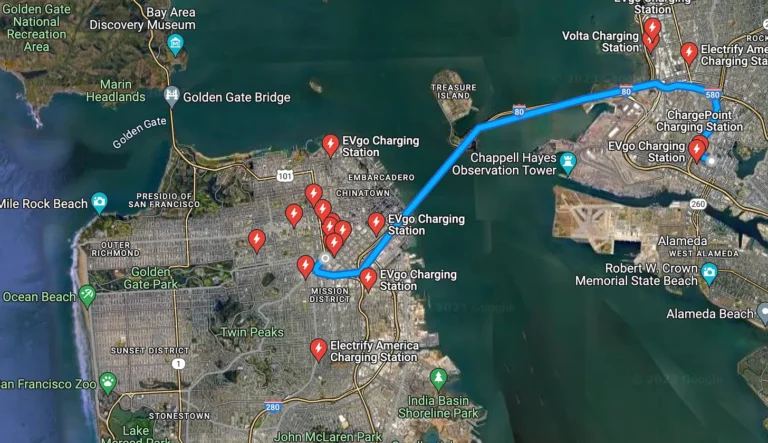

Tesla and Ford have discovered that the demand for $60,000 plus EVs is minimal. Adoption of EVs has already slowed because of battery life anxiety, charging station shortages, and range. It may be that the only way to entice American drivers into EVs is price. Tesla plans to do so, and Ford will counter that directly.

More from ClimateCrisis 247

- Wind And Solar Face Real Damage Under Trump Laws

- Europe Tesla Sales Plunge 40%

- There Are No Cheap Used EVs

- EV Sales Skyrocket, According To Study