Ford Could Lose $40 Billion In Sales.

Ford’s CEO Jim Farley made a statement mainly hidden in the background of the EV sales implosion, Tesla’s low sales, and worries that China’s electric car companies could batter auto companies in the UK, EU, and US. “If you cannot compete fair and square with the Chinese around the world, then 20-30% of revenue is at risk,” he said two months ago. He did not say what was “fair and square,” but he might have referred to China’s low manufacturing costs, which no Western manufacturer can match.

Big Pollution –Exxon

EV News –Cheapest EV In America

China has shown that it has at least two competitive advantages. Companies like EV giant BYD can profit from selling cars for less than $15,000. The other is that China has the world’s largest car market, so BYD and its rivals can count on local sales to fuel its global ambitions.

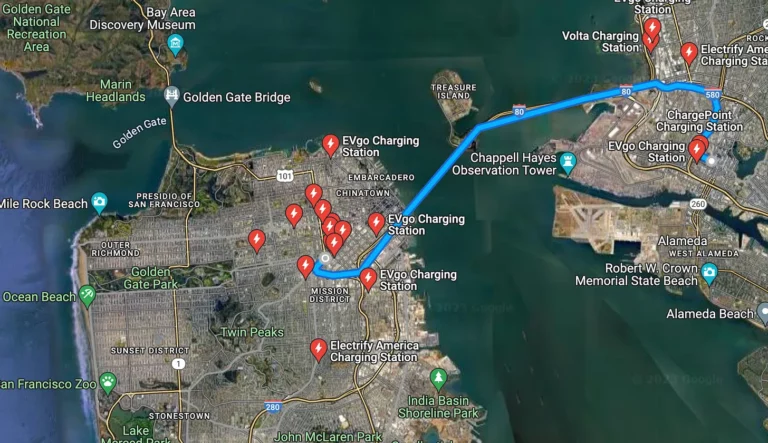

EV sales around the world have slowed, even in China. However, that decrease is expected to be temporary. Fossil fuel-powered cars may be less expensive when gas prices are low. And it is more convenient to find gas stations than charging stations. Each of those is likely to change. Among other things, oil prices surged above $100 two years ago because Russia invaded Ukraine. Geopolitical challenges are moving crude in that direction again. Interruption of Middle East production and a spike in gas prices caused a shift in American driving habits in the 1970s. It will happen again.

EU And US EV Rules

European and US governments continue to pressure car companies to make their vehicles more fuel-efficient. The only way to achieve this is for manufacturers to make EVs a success. Governments may also have to underwrite charging station networks. It will be a small price to make a critical impact that will contribute to slowing global warming.

Even as EV sales continue to rise, albeit slower than in the past several years, Ford has hurdles that will take tremendous work to clear. First, the EV market will be crowded by its traditional competitors like GM and VW. The other is that Chinese companies will enter the EU and the US, driven by consumer demand for access to EVs at low prices. Government regulation can only undermine their citizens’ living costs for so long. And BYD may have already come up with a partial solution. It can make cars in Mexico and then move them into the US.

Farley did not mention one of Ford’s weaknesses, which may be critical to whether it will continue to lose tens of billions of dollars during the EV revolution. Ford has shown that it can fumble the launch of EVs more than any other large company in the industry. Wrong price points and flawed design botched the F-150 Lightening and Mustang Mach-E launches. Ford touted these vehicles as its future just a year ago, and now it is retreating from this part of its business as fast as it can.

Farley often needs to be corrected when he makes public comments. His comments about Ford’s drop in future revenue could be an exception.