Hertz EV Business Gets Wrecked

EV adoption in the US has taken another major blow. Hertz, America’s iconic car rental company, set a deal to buy 100,000 Teslas two years ago. Today, in a filing with the SEC, Hertz stated it would sell 20,000 of those Teslas and that it would take a $245 million writedown.

An old trend: Americans love gas guzzlers.

The most damaging sentence in the Hertz filing was, “The Company expects to reinvest a portion of the proceeds from the sale of EVs into the purchase of internal combustion engine (“ICE”) vehicles to meet customer demand.” The rental demand for gas-powered cars is brisk. Hertz also said some EV rentals were “low margin.”

Hertz had also said it would buy EVs from GM and Polestar. Overall, it planned to have an EV fleet in the six figures. Now, It is hard to imagine how few EVs there will be in this fleet.

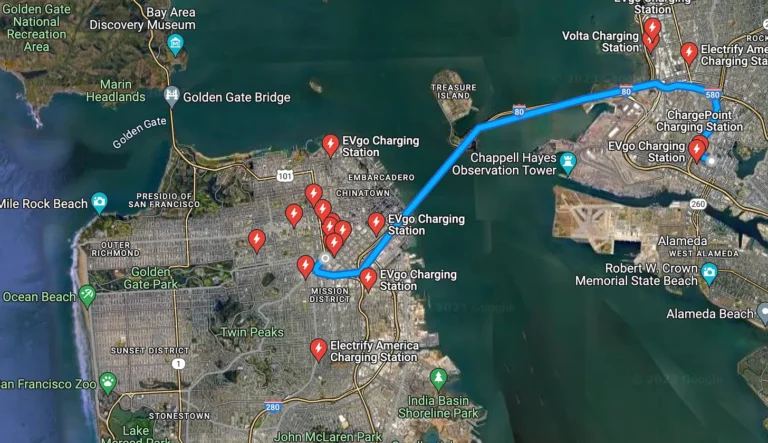

Imagine renting an EV from Hertz. Range is an issue if a renter plans to drive more than 200 miles. Charging time is also important, whether the renter is on vacation or business. Many people charge their EVs in a home garage. Hertz customers don’t have that luxury. EV drivers also need a very modest amount of training if they operate one for the first time. Who will do that? Hertz?

The EV industry can ill afford more trouble. While Tesla has 50% of the US market, it is not a market that is growing quickly. Ford and GM have both retrenched in terms of production and future investment. Ford recently said its $12 billion investment in EVs would be delayed.

The US car industry has made several miscalculations in the last two decades, and now it has made another. It chased high gas prices with high mileage cars only to find that Americans wanted SUVs, pickups, and crossovers, which tended to get lower mileage. Ford abandoned the sedan business in the US almost completely in 2019. Its latest attempt to rotate to EVs is vehicles like the Mustang Mach-E. That rotation is under siege.

Additionally, as the industry produces fewer EVs than expected, smaller manufacturers like Lucid are in increasing trouble. Growing demand was essential to their survival.

The EV future looks nothing like the industry thought it would less than a year ago.

More from ClimateCrisis 247

- Wind And Solar Face Real Damage Under Trump Laws

- Europe Tesla Sales Plunge 40%

- There Are No Cheap Used EVs

- EV Sales Skyrocket, According To Study