The Huge Risks Of An EnergyX Investment

EnergyX (Energy Exploration Technologies Inc.) claims it can create lithium extraction technology that can extract 300% more than current technologies. GM is the lead investor in a $50 million round. Of course, GM’s investments in the next generation of transportation have been a disaster. It can’t sell EVs, and its autonomous driving company, Cruise, has an existential problem after a severe accident involving one of its vehicles in California. Leaving that aside, EnergyX has a very long list of risks in its SEC filing to offer 8,500,000 shares of common stock.

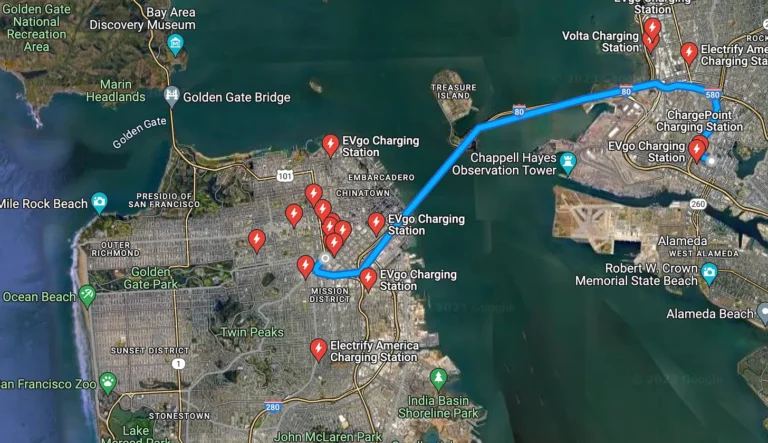

How good are EVs? The EV car of the year.

Among these risks is that the company says it has a “going concern” risk. That means a risk that it can remain in business in its current form. (If it cannot, the peril to common stockholders is large).

Among the other risks in the SEC filing: 1) We have little operating history on which to judge our business prospects and management. 2) We will need, but may be unable to obtain, additional funding on satisfactory terms, which could dilute our stockholders or impose burdensome financial restrictions on our business. 3) Failure to properly manage costs may have an adverse impact on us 4) We may be affected by regulation of our Customers Mining Operations in South American Salars, 5) We may face difficulty in scaling up our product to a commercial scale, 6) If we become involved in litigation, our operations and prospects may be adversely affected. 7) Significant long-term changes in the battery storage and electric vehicle space could adversely impact our business. This is not the entire list.

EnergyX has raised $65 million from 9,400 investors. It’s a long shot.

More from ClimateCrisis 247

- Wind And Solar Face Real Damage Under Trump Laws

- Europe Tesla Sales Plunge 40%

- There Are No Cheap Used EVs

- EV Sales Skyrocket, According To Study